Don't risk unpaid invoices. Get Coface credit insurance & grow safely.

Are you a small business owner? EasyLiner helps your business grow safely, by protecting it against losses from late and unpaid invoices.

The easiest way to

continuously protect

your business

Did you know that 80% of businesses face unpaid debt?

Easyliner is a Coface commercial credit insurance solution for small businesses that helps your business grow safely by protecting it against losses from unpaid invoices.

Adjust the sliders to see just how much an unpaid invoice could end up costing your business...

Additional Turnover to Generate R

What does EasyLiner Include?

Prevention

Get information and credit opinions on your buyers and prospects, secure your business transactions.

Protection

We protect your business from payment default and from the longer late payments.

Debt Collection

Allow us to handle your debt recovery, so you can focus on what matters most to your business.

Indemnification

We compensate up to 85% of your covered invoices in the case of non-payment insolvency of your buyers.

All Easyliner benefits in a 94 seconds video

How much can trade credit

insurance cost?

How Does a Trade Credit

Insurance Policy Work?

With Coface, your credit insurance policy works simply and easily:

- You provide us with financial data about your company and clients.

- We assess your customers' financial health so we can draw up credit limits and commercial terms.

- We monitor your clients around the clock and tailor the coverage accordingly for the entire term of the policy.

- In time, we can include your new clients in the policy and extend existing customer coverage.

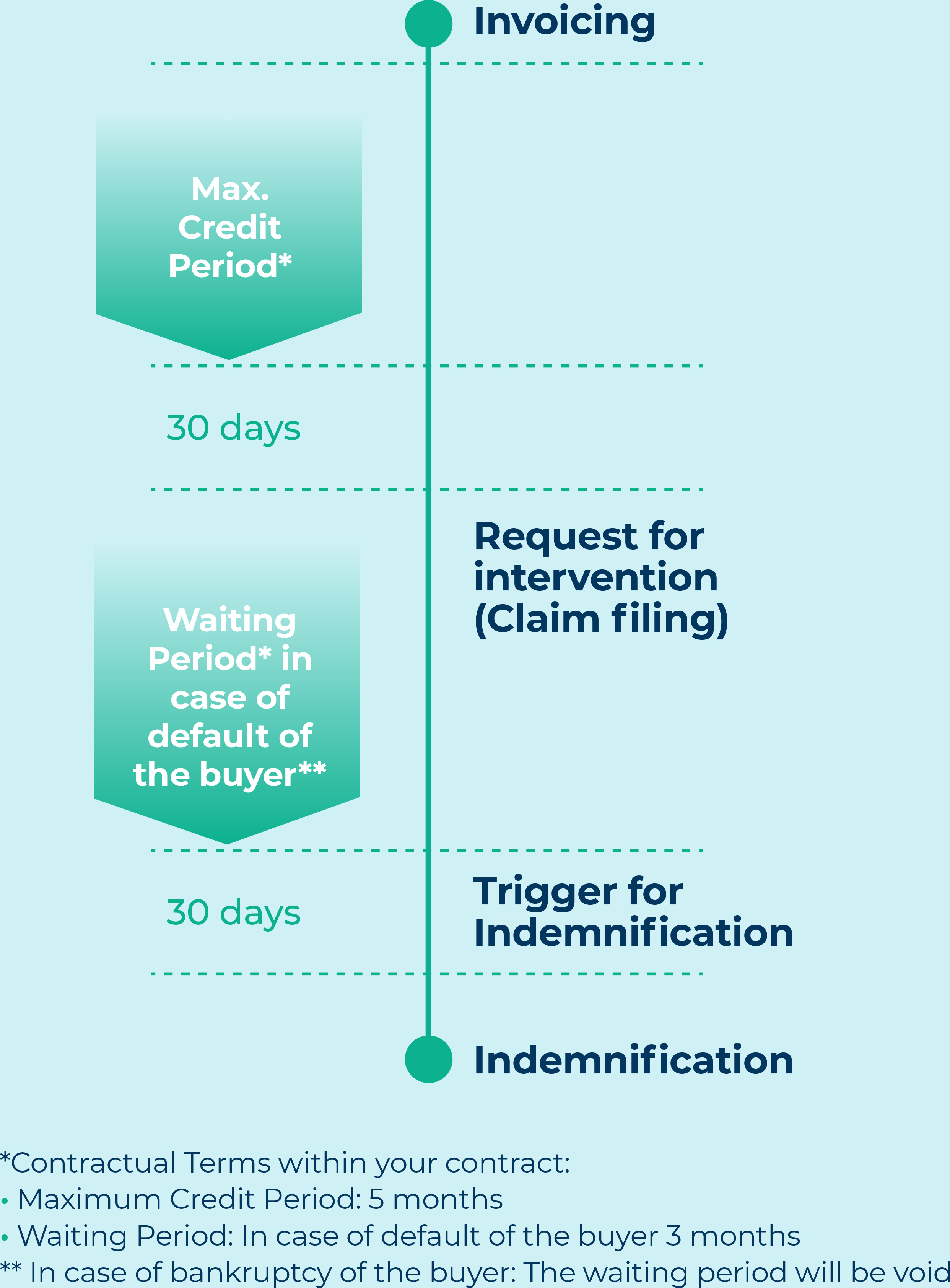

- If your clients do not pay in a timely manner, our debt collection services ensure that most of your unpaid invoices are settled. Or we would indemnify you according to the policy conditions and short timeframe.

See how Easyliner works

Why Coface?

• 75 years as a global leader in credit insurance

• 195 million businesses monitored globally

• Online tool to support your decisions and boost your business

• Data adjusted by country, sector and current economy

• Exclusive business intelligence including updated credit scores, risk analyses, credit opinions, ongoing company monitoring, and more.

Coface Key Figures

75

Years as a global leader in credit insurance

195

Million businesses monitored globally

10K

Credit decisions taken by Coface every day

200

Operating in 200 markets