In the dynamic world of transportation, the sector is experiencing a rollercoaster ride filled with highs and lows. From the sustained momentum in air transport in Asia to the significant setbacks caused by the unrest in Ukraine and the Middle East, the industry is at a crossroads.

In this blog post, we delve into the strengths and risk assessments of the transportation sector, shedding light on the economic insights and environmental concerns that shape its trajectory.

1: EMERGING MIDDLE CLASSES IN ASIA

China, India, Singapore, Thailand, and Vietnam have seen their middle-class populations take a place among the fastest-growing globally. According to the Brookings Institution, it is estimated that by 2030, two in three members of the middle class will be from Asian countries. This rise has fueled sustained long-term momentum in air transport.

As consumer spending picks up, the demand for international trade has rebounded significantly, and we can expect for this to continue.

To learn more about the challenges influencing the transport and logistics industry, download our latest whitepaper.

2: TECHNOLOGICAL ADVANCES FOR COST REDUCTION

Continuous technological advancements are contributing to cost reduction in the transportation sector. Technical progress, especially in the air and maritime segments, is paving the way for more efficient operations and reduced costs in the long term.

Supply chain optimization has been a focus for many years now, but the huge developments in AI and machine learning have accelerated advancement. Real-time data fed route optimizations, IoT predictive maintenance systems, and many other tools are driving efficiencies in the industry.

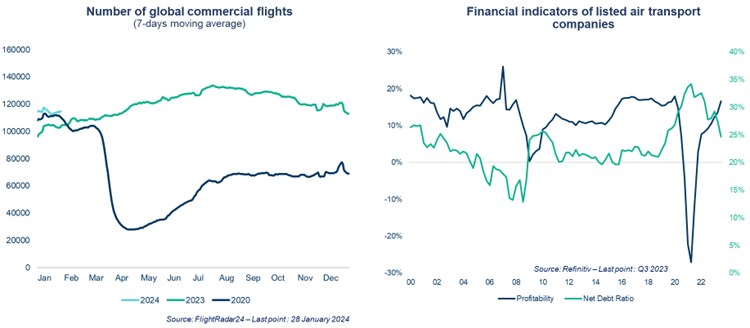

3: RECOVERY FROM THE PANDEMIC

Among the many sectors impacted by the COVID-19 pandemic, the logistics industry faced substantial challenges and remains deeply affected by its aftermath.

With border closures and disruptions to supply chains and trade, the sector had to undergo significant transformations to adapt. This involved embracing new technologies and methodologies to navigate the changing landscape effectively.

Now online sales are growing (2023 numbers are looking to have exceeded $8 trillion), and businesses are also benefitting from the innovations that they have implemented.

1: THE IMPACT OF CONFLICTS

Russia’s military offensive in Ukraine poses a potential negative impact on the travel and logistics industry. This situation has intensified existing challenges such as increased transportation costs and elevated oil prices that have risen over 70% since war first declared.

The conflict between Israel and Palestine has significantly impacted the travel and logistics industry in multiple dimensions. The immediate repercussions of the war were evident in the suspension of flights to and from Israel by major carriers such as FedEx, UPS, DHL, and Lufthansa. Security concerns and operational challenges were cited as the primary reasons behind this decision.

Sea freight has also felt the effects of the conflict. Israel's ports, particularly the Port of Ashdod and the Port of Haifa, have been targeted by rockets and missiles. This has led to disruptions, delays, and congestion in maritime operations, accompanied by heightened security measures and increased costs.

2: DEPENDENCY ON OIL PRICE FLUCTUATIONS

The sector is highly dependent on oil price fluctuations, impacting operating costs. Rising oil prices increase transportation costs, potentially raising prices for goods. This, along with higher energy costs, contributes to increased inflation, reducing consumers' purchasing power.

To gain insights into the projected oil prices for 2024, it's crucial to closely monitor the overarching trend in the global economy as the demand for oil is intricately linked with economic activities.

The decision by OPEC+ to reduce output wasn't driven by an oversupply of oil but rather a sagacious anticipation of the imminent economic deceleration. As we step into 2024, the indicators for the global economy are not particularly robust, and despite suggestions of a gentle economic slowdown, the likelihood of a recession remains high. Consequently, the outlook for oil prices in 2024 leans more towards downside potential than upside.

3: ENVIRONMENTAL CONCERNS

There’s no hiding the huge contribution to greenhouse gas emissions that the logistics and supply chain industry produces, but the answers aren’t simple. Pressure for change from customers and governing bodies is there, but challenges remain. Initial hurdles include implementation costs, reliable partners and of course the desire to change after an exhaustive last few years fighting the impacts of the Covid-19 pandemic. Organizations unable (or unwilling) to take the steps needed could find themselves out of favor within the market as their competitors race ahead.

When it comes to transport, suppliers appear to be embracing eco-friendly choices and becoming more mindful of their environmental and community impact. Among consumers, there is a growing demand and expectation that businesses will be responsible in how they plan their logistics.

Businesses have to carefully manage the balance of meeting their customers’ environmental expectations with the costs of implementing the solutions to do so. Some will get it right, but unfortunately, many will not. Use Coface data to determine the likelihood of your partners and suppliers’ probability of success (or failure).

Navigating the credit risks

While the industry is making a positive recovery from the last few years, there remain challenges ahead. It’s important that your business monitors the entire supply chain in 2024. Precise business intelligence helps to spot the organizations that are performing well and make smart business decisions.

In this evolving landscape, Coface stands as a strategic ally, offering expertise in risk management and economic insights. Coface is a global leader in risk management with 75+ years of experience, with 50,000 clients over 100 countries. With 700+ credit analysts and underwriters and renowned macro and micro-economic expertise.

With Business Information services, Coface provides you with professional analysis that allows you to monitor developments across your entire business network. This includes tools like URBA 360, an interactive information tool loaded with unique insights, helping your business manage trade risks from one centralized place.

In the dynamic world of transportation and logistics, your business faces myriad risks that can impact your operations and financial stability. Managing risks can be challenging, particularly when dealing with new trading partners. But identifying and understanding risks can empower you to make confident decisions quickly.

Unleash the power of URBA 360 by Coface and unlock a world of possibilities. Our all-in-one suite of risk analysis and decision-making insights is designed to help you avoid bad debt and identify growth opportunities.

Whether you need credit checks on new suppliers, opinions on credit limits or risk assessments on customers, we have a solution.

Sign up for a demo today.

© Copyright Coface 2024

600 College Road East, Suite 1110

Princeton, NJ 08540

Coface North America is a branch of Compagnie Française d’Assurance pour le Commerce Extérieur ("Coface") SA, a limited company registered in France under number RCS Nanterre B 552069791 and with a registered capital of EUR 137 052 417,05.