Coface-Barometer

November 2024

Mehrmals im Jahr teilt die Coface Schweiz Analysen zur Entwicklung der globalen Wirtschaft. Das Ziel ist es, große Trends hervorzuheben und ihre lokalen Auswirkungen zu erklären. Dazu gehören auch die Auswirkungen in der Schweiz und den Vereinigten Staaten. Dieser Barometer ist uns besonders wichtig. Er bildet eine wesentliche Grundlage für unsere Entscheidungsfindung.

Vom monetären Wendepunkt zur steuerlichen Wende?

Wir haben unsere Prognose für das globale Wachstum im Jahr 2025 (leicht) auf 2,6% nach unten korrigiert, also auf dasselbe Niveau wie in diesem Jahr. Während wir unsere Prognosen für eine anhaltende Abschwächung in den USA und China beibehalten, liegt die leichte Anpassung hauptsächlich im Euroraum, dessen Erholung in Deutschland zunehmend unsicher erscheint.

Globale Wirtschaft

Die weiche Landung der globalen Wirtschaft verläuft insgesamt recht reibungslos, wenn auch sehr unterschiedlich und nicht überall im gleichen Tempo. Während die Erholung in den USA in kleinen Schritten vorangeht, geschieht dies in Europa eher limitiert und unsicher. China steckt weiterhin in seinen strukturellen Problemen fest und kämpft darum, wieder auf die Beine zu kommen.

Inflation

Die Inflation scheint vorerst besiegt zu sein, was den Zentralbanken etwas Spielraum verschafft. Sie können ihren strengen Kurs lockern, zumindest vorerst. Unabhängig von den Ursachen scheint die Desinflation gut voranzukommen. Die Ziele der großen Zentralbanken sollten im Verlauf des Jahres 2025 erreicht werden.

Staatshaushalt

Eine neue Ära der Haushaltskonsolidierung zeichnet sich ab. Diese ist sowohl bedauerlich als auch notwendig. Sie markiert eine Rückkehr zu strengeren, weniger grosszügigen Finanzbedingungen. Dies geschieht trotz geldpolitischer Lockerung. In Europa und in vielen Schwellenländern ist dies bereits der Fall, da die öffentlichen Finanzen durch eine Reihe von Krisen belastet wurden.

Situation in Europa:

Zwischen Ersparnissen und Abschwung

In diesem Herbst hat sich ein Gefühl der Besorgnis über Europa gelegt. Im Frühling gab es noch Hoffnung auf eine Erholung in der Eurozone. Diese Hoffnung hat jedoch einer gewissen Ernüchterung Platz gemacht. Einerseits bleibt der Konsum der Haushalte sehr zögerlich und viele Investitionen werden verschoben. Andererseits erholt sich der Außenhandel nur vorübergehend aufgrund gemischter wirtschaftlicher Aussichten in den Vereinigten Staaten und in China.

Haushalte tendieren zu Einsparungen

Wir beobachten ein reales Lohnwachstum aufgrund steigender Tariflöhne und sinkender Inflationsdruck. Dieser positive Trend zeigt sich jedoch mehr in einem Anstieg der Sparquote als in einem Anstieg des Konsums.

Die Unternehmen zahlen hauptsächlich den Preis dafür. Ihre Margen brechen weiter ein, was seit 2016 zu einem Rekord an Insolvenzen in einigen großen europäischen Ländern geführt hat.

Geldpolitik: Entspannung in Sicht

Nach zwei Jahren mit Zinserhöhungen oder hohen Zinssätzen haben in diesem Jahr Zinssenkungen begonnen. Die EZB hat seit Juni mehrere Zinssenkungen beschlossen und wird diesen Trend voraussichtlich fortsetzen, bis ein „neutraler“ Zinssatz erreicht ist. Ein solcher Zinssatz führt weder zu einer Ermutigung noch zu einer Hinderung der Wirtschaft.

In der Eurozone wird dieser Wert derzeit auf etwa 3% geschätzt. Aufgrund der langen Laufzeiten von Krediten wird es jedoch einige Zeit dauern, bis die geldpolitische Lockerung die Unternehmen und Haushalte erreicht.

Rückgang der Investitionen

Während der Pandemie sind die Haushaltsdefizite und die öffentliche Verschuldung in allen Ländern erheblich gestiegen. Auch wenn dies damals eine angemessene Antwort auf die globalen Herausforderungen war, ist es jetzt problematisch. Tatsächlich haben diese Ausgabenpolitiken oft nicht zum Sparen verleitet.

Im Juli hat die EU ein Defizitverfahren gegen sieben Länder eingeleitet: Belgien, Frankreich, Ungarn, Italien, Malta, Polen und die Slowakei.

Die Schweiz und ihre europäischen Partner

Wenn der Trend in der Eurozone negativ ist, hat sich die Schweiz deutlich von ihren europäischen Partnern abgehoben. Im ersten Quartal 2024 lag das BIP-Wachstum bei 0,5% (bereinigter Wert). Im zweiten Quartal betrug die Wachstumsrate 0,7%. Diese Wachstumsraten ähneln denen vor der Pandemie.

Diese gute Leistung ist mit zwei Faktoren verbunden. Einerseits waren die Inflationsniveaus in der Schweiz nie so hoch wie im Rest Europas. Andererseits hat die Schweiz ihre öffentlichen Finanzen stets unter Kontrolle gehalten.

Zinssätze und Inflation

Die Schweizerische Nationalbank hat die Zinssätze bisher um 75 Basispunkte auf 1% gesenkt. Dieser Wert ist im Vergleich zur Eurozone relativ niedrig, wo er Anfang Oktober bei etwa 3,5% lag. Der neutrale Zinssatz wird bei etwa 0,5% erwartet.

Wachstumsausblick

In diesem Kontext prognostiziert Coface ein Wachstum von 1,5% im Jahr 2024 und von 1,8% im Jahr 2025. Die Stabilität des Haushalts, das sehr geringe politische Risiko und das hohe Niveau der wirtschaftlichen Entwicklung erklären die unveränderte Note A1 für die Schweiz.

Bedenken bezüglich Unternehmensinsolvenzen

Im Verlauf der ersten neun Monate des Jahres 2024 wurde ein signifikanter Anstieg festgestellt. Die Zahlen liegen 13% über denen des gleichen Zeitraums im Jahr 2023. Im September 2024 wurden rund 1.100 Insolvenzen registriert. Dies ist eine außergewöhnlich hohe Zahl.

Newsletter Anmeldung

Um mehr über Coface zu erfahren und regelmäßig unseren Newsletter zu erhalten, melden Sie sich einfach an. Wir kommunizieren hauptsächlich per E-Mail.

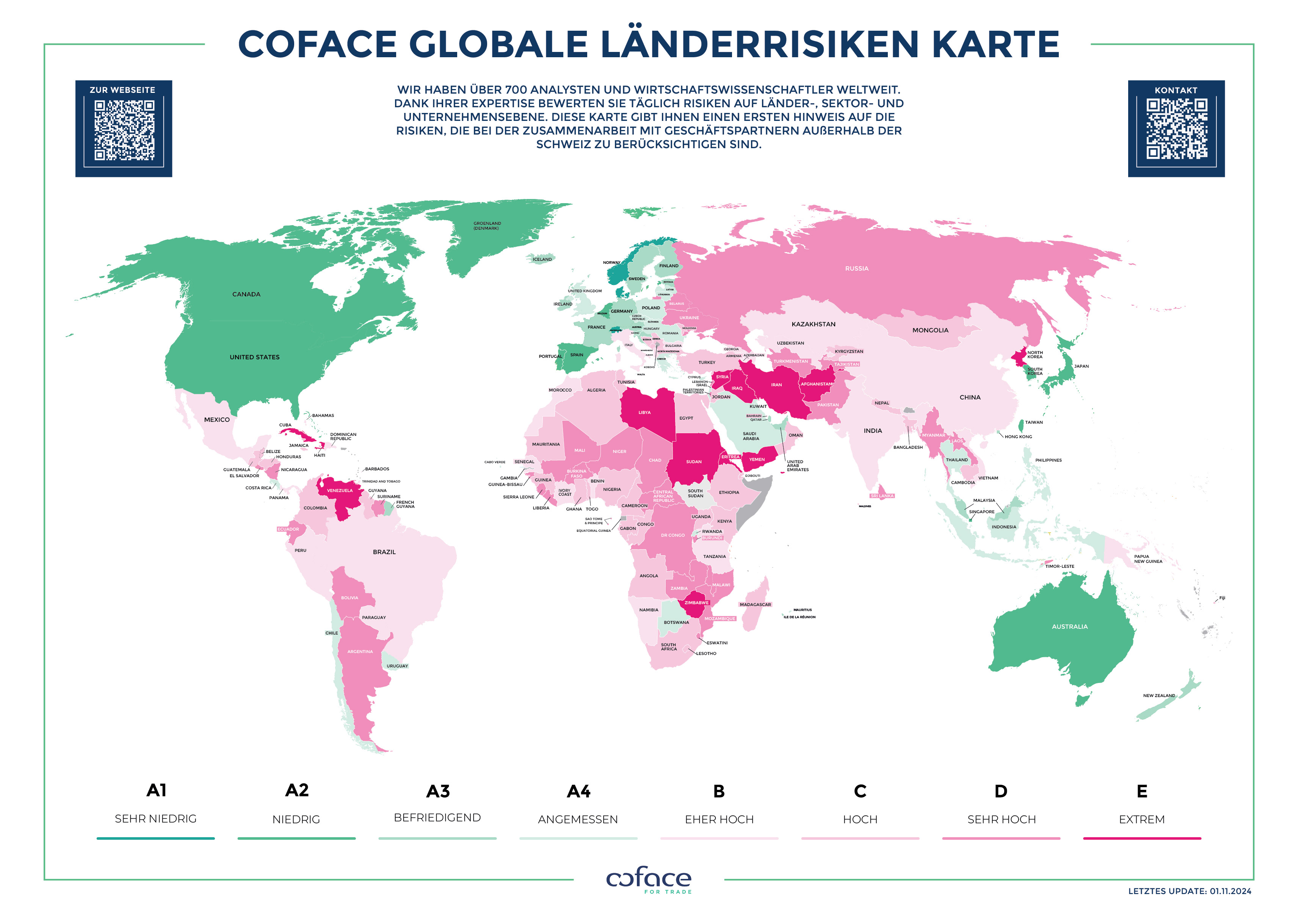

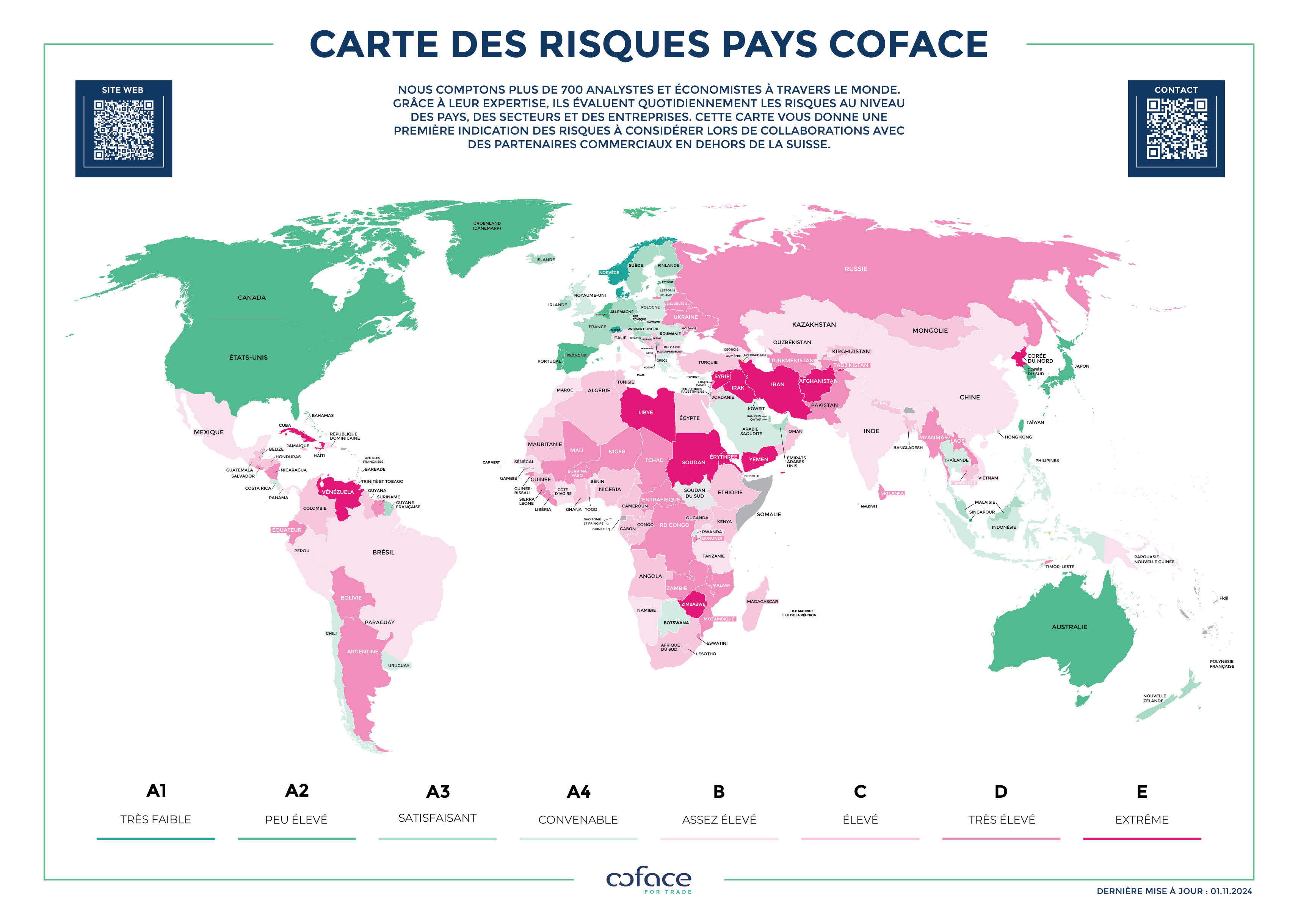

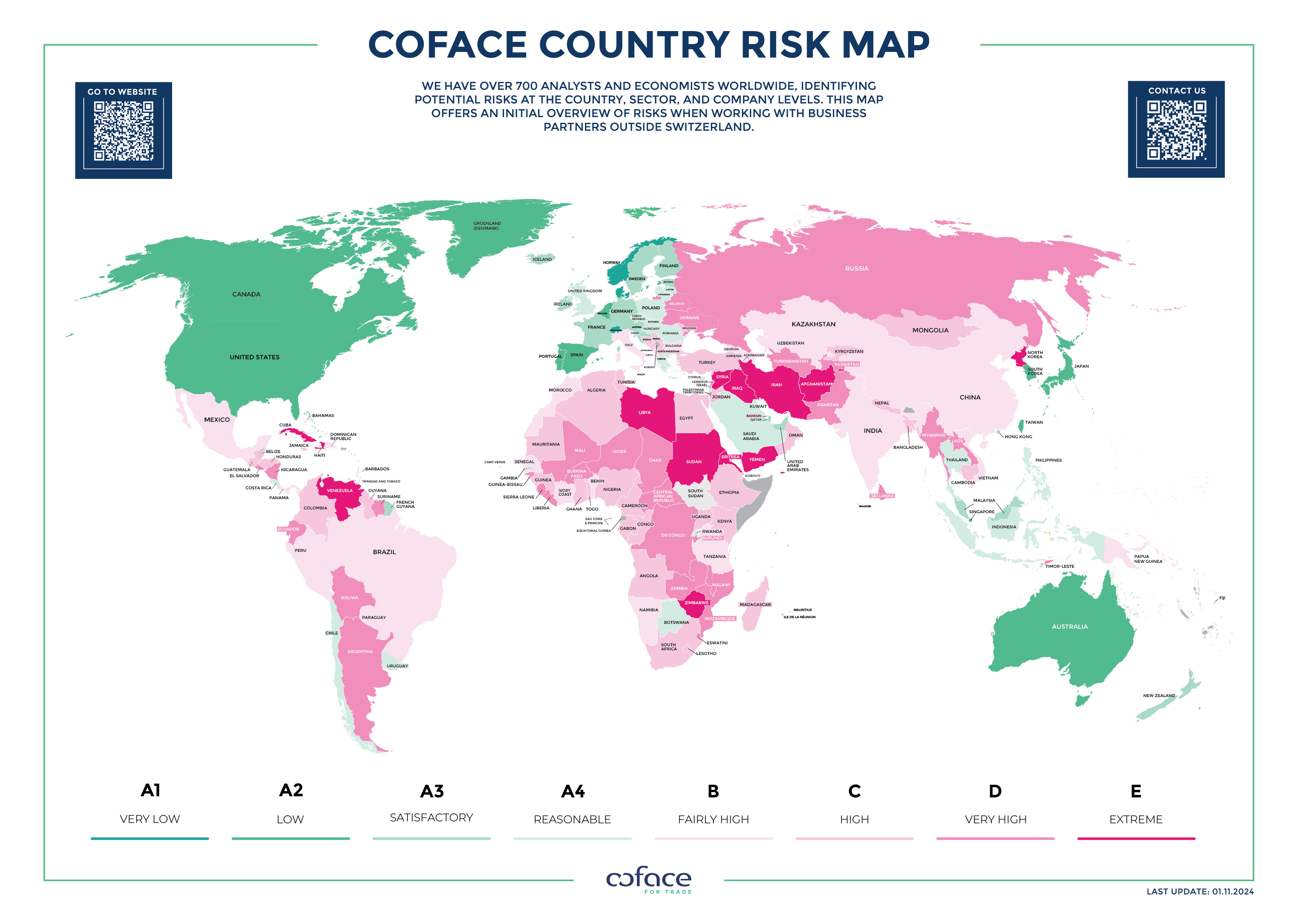

Stabilität der Länderrisiken

Nur vier Länder haben eine höhere Bewertung erhalten.

In Europa

Albanien (von C auf B) und Zypern (von B auf A4) haben von starkem Tourismus und besseren wirtschaftlichen Aussichten profitiert. In Albanien wird zudem eine beispiellose politische Stabilität beobachtet, während Zypern langsam, aber sicher seine Staatsverschuldung reduziert.

In Afrika

Ruanda (von B auf A4), das sich als Dienstleistungszentrum (Finanzen, Logistik, Transport) in Ostafrika etabliert hat, wurde ebenfalls aufgewertet. Die große politische Stabilität und hohe Rechtssicherheit des Landes haben dazu beigetragen.

Über den Atlantik

Kostarika (von B auf A4) profitiert vom Nearshoring-Trend der USA (Verlagerung der Produktion näher an die Verbrauchermärkte, um Lieferkettenrisiken zu vermeiden).

Im Nahen Osten

Israel leidet unter den Folgen des Krieges. Die Kriegsanstrengungen reduzieren die Produktionsaktivitäten, was zu einer Herabstufung der Bewertung auf A4 führt.